Other businesses have started providing carefully curated meal kits from suppliers like HelloFresh direct to staff or of their offices. Ramp may help you narrow prices and more effectively handle G&A bills throughout your complete group. Vendor contracts present important alternatives for cost reduction, especially when you may have established relationships or can show your value as a customer. Start by gathering data on your present spending with each vendor and research alternative distributors out there to establish aggressive benchmarks.

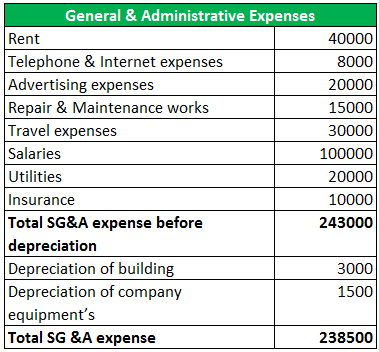

Expenses tied to production, like price of goods bought, uncooked supplies and direct labor, typically aren’t included in G&A bills. Selling expenses, including advertising and advertising costs and sales commissions, also don’t depend as a result of they generate revenue. Manufacturing overhead, for instance, goes in course of working a revenue-generating production facility somewhat than basic business operations. General expenses are the operational overhead expenses that impact the entire business. Administrative bills aren’t directly tied to a selected https://www.simple-accounting.org/ company perform or division like gross sales or manufacturing.

- Hire is a big overhead expense that companies incur for his or her space.

- Correct oversight helps stop overspending on overhead costs and helps you make good monetary decisions to drive future development.

- Whether you are operating a construction firm, a restaurant, or any small enterprise, you will have to cowl general and administrative bills (G&A).

- Enterprise leaders want clear financial information to make good choices.

- An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Coverage Corporation or any other authorities agency.

These instruments are particularly helpful for SaaS companies seeking to monitor G&A costs and other core metrics in actual time. By making it simpler to identify outliers and patterns, you can act sooner to reduce back inefficiencies and improve monetary visibility. Some G&A bills are semi-variable—meaning they shift primarily based on your company’s evolving needs, not necessarily in direct response to revenue or buyer development. These costs typically fluctuate based mostly on discretionary investments, quite than operational necessity. Some general and administrative (G&A) prices are mounted, meaning they remain constant regardless of new sales or buyer growth.

Centralise Vendor Administration

Mounted costs don’t depend on the volume of services or products being purchased. They are usually primarily based on contractual agreements and won’t enhance or decrease until the agreement ends. These amounts must be paid no matter revenue earned by a business. A small firm overspending on administrative salaries without streamlining tasks may undergo reduced profitability.

Challenges In Managing G&a Expenses

Others use meals supply companies to ensure each employee has options suited to their dietary wants. We sometimes consider these prices as being directly tied to sales. Begin by making a complete inventory of all software program subscriptions throughout your group.

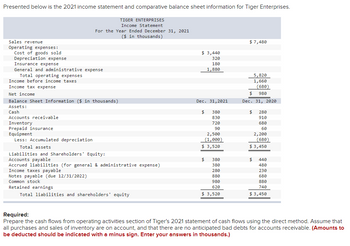

Regularly reviewing G&A expenses can uncover inefficiencies or overlapping prices across your operations. Figuring Out and eliminating unnecessary spend helps streamline workflows and defend your bottom line. More importantly, having a clear, accurate view of G&A ensures your monetary choices are grounded in actual data—not assumptions. It frees up price range for progress initiatives like product development and customer acquisition—while also boosting operational effectivity and profitability. To calculate common and administrative (G&A) prices, begin by identifying which expenses fall into this category.

G&A contrasts with price of products sold (COGS) (direct manufacturing costs) and selling expenses (the “S” in SG&A), which support revenue generation from goods, providers, and gross sales. Here’s a quantity of examples of G&A expenses and how they could appear in your earnings statement. Spendesk provides payment methods for modern businesses, and a powerful platform for finance teams to handle spending. This is shipped directly to their supervisor for validation, and on to the finance team.For finance teamsEach worker has their own Spendesk profile and debit expense card. So in contrast to the corporate credit card, you always know who’s spending firm cash.The platform lets controllers create spending limits and pre-approvals.

Monitor Your G&a Prices Intently

Sensible G&A administration balances price efficiency with the need for strategic funding, ultimately enhancing profitability and development potential. Understanding general and administrative bills also helps you set your pricing appropriately. If these bills are too excessive, they may eat into your profit. Figuring Out your whole operating expenses offers you a transparent image of how much you have to earn to cover both production costs and overheads. Strategically managing G&A bills may help improve income by reducing your overall price of operations.

On occasion, it could also embody depreciation expense, relying on what it’s associated to. At its core, G&A covers the costs incurred for the general administration and administration of a business entity as a complete, somewhat than being tied to particular functions like production or gross sales. Assume of G&A because the bills needed to keep the lights on and the enterprise operating strategically. A good spend management device will seize each fee your teams make, then categorize them and assign them to the proper budgets. So you’ll know in real time – and without any knowledge entry – how much you spend on meals, electronics, hire, and utilities.

IRS Publication 334, aimed at small companies, also covers deducting bills like workplace lease, utilities, and professional fees on Schedule C. Businesses can take a glance at process optimization to scale back their common and administrative costs. This includes identifying and eliminating wasteful practices, automating routine duties, and improving the overall effectivity of administrative processes. Course Of optimization can result in a extra streamlined operation and vital price financial savings over time.